When you do any research about the hardware wallet industry, your first big realization is that the market is Ledger’s to lose.

The second thing you realize is that the whole industry is a very small subset of the crypto space. According to a few independent reports from Chainalysis and NYDIG, about 60% of all crypto is held in a centralized manner. That means assets are being held on an exchange or by a custodian.

This goes against one of the core tenets of crypto: decentralization. And this is a major regulatory and security threat to the ecosystem.

Hardware wallet market analysis and insights

Over the coming few days, I’m looking at the hardware wallet industry. I’m publishing my findings as I go. Follow along if you’d like as I learn in public. Some of this will be tough going as this is a fledgling industry and all the companies are private. This makes it tough to gather a lot of information about any company in the space.

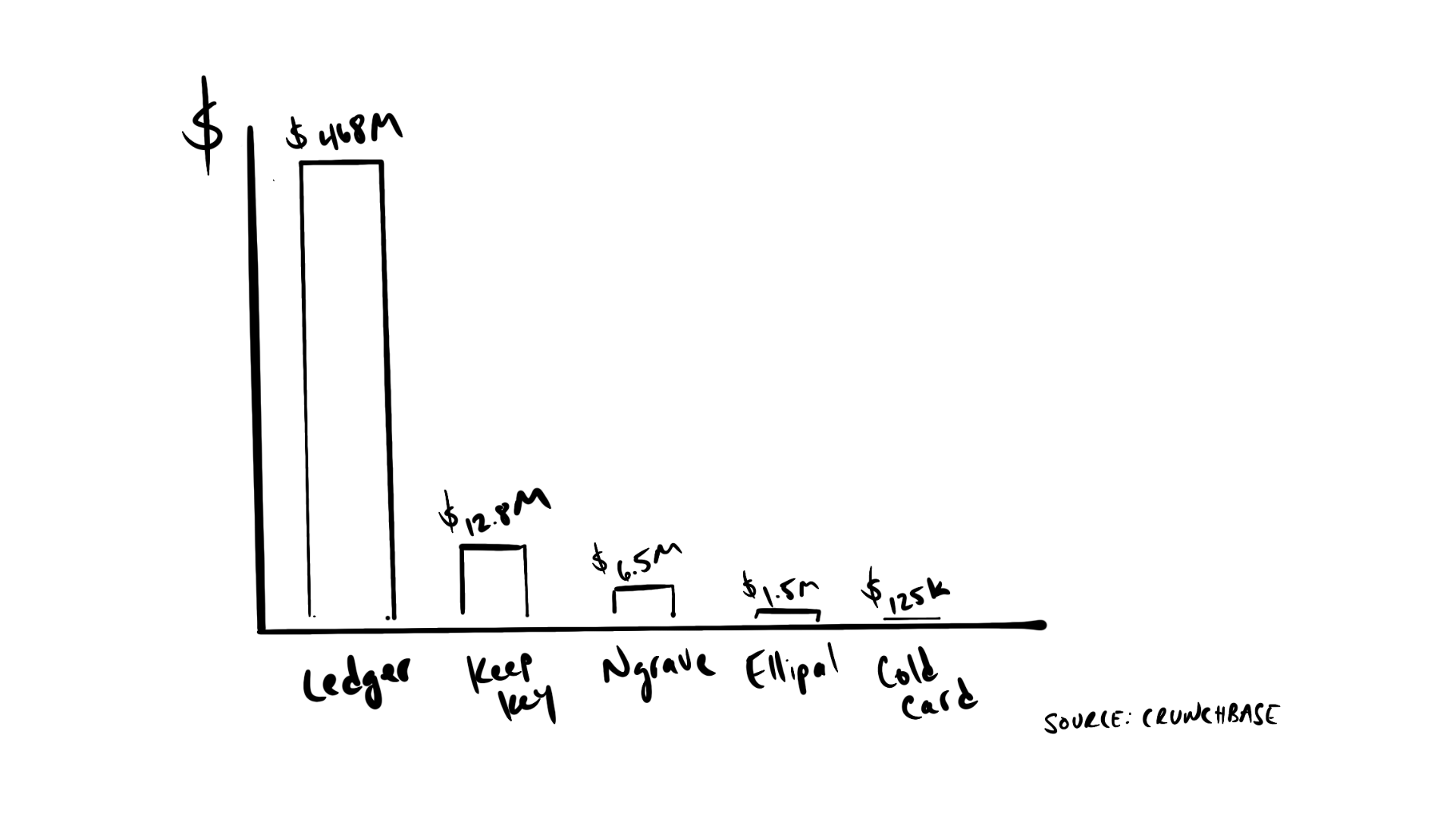

Ledger has a massive funding advantage

I compiled the most extensive list of hardware wallet companies and cross referenced each company with Crunchbase. I was surprised at how few companies have funding. Of the 18 companies that appear to have a hardware wallet, only 5 have attracted VC funding. Ledger has raised $468M and the next closest came in at $12.8M. Advantage Ledger. Holy shit.

It’s not clear that Ledger has a lot more customers than their competitors

Despite Ledger’s deep pockets, from my initial research it’s not clear that they have a proportional share of the market. Ledger’s website says they have 4 million customers and one graph from 2019 indicated that they had no more than 15% of the market. Closely followed by Trezor. I couldn’t find multiple sources to verify this information yet.

4x industry growth predictions are way too low

A number of market reports predict strong growth in the 4-5X range over the remainder of this decade. My gut tells me this is a conservative estimate. Brain Armstrong, CEO of Coinbase, recently suggested that self-custody is a priority for Coinbase. This is telling because Coinbase’s core business should see self-custody as a threat to revenue. Perhaps Coinbase is realizing that their security model can’t scale with the future growth of the industry.