I was a sharp-shootin’ hunter on the Oregon Trail, the pixelated educational computer game from the 90s. Anyone who passed through an elementary school in the decade prior to Y2K will admit The Oregon Trail was a poor excuse for a video game, but it was the epitome of fun in a classroom.

So imagine the excitement when our fifth grade teacher announced to the class that we would be reliving the settlers’ journey as they crossed the American West. We would embark on a ‘real-life’ Oregon Trail right in our beige cinder block classroom.

The real-life game was split into two parts. First, we journeyed west then we built a town in our new found paradise. We were no longer travelers, we were settlers, and the teacher assigned each of us a role. Some of us were to be farmers, blacksmiths, and shop keepers. I was the tavern owner.

ADHD Adam was the banker. I’m not sure what happened, but all of a sudden, ADHD Adam was rich as shit. He became a profit-maximizing tyrant and ran the whole town. The game was pointless after that. It wasn’t so much Adam. It was the banker he had become.

He taught me my very first, and most important, economics lesson.

I went on to study economics in college and as a rite of passage, I explored becoming a banker myself. I took the field trip to Wall St, which wasn’t too different from a fifth grade field trip. Instead of a stuffy museum, you got the commotion of a Wall Street trading floor and panoramic views of Manhattan at lunch time.

Wall Street was chocked full of ADHD Adams in pristine suits and pastel coloured ties. It was like a bunch of recess-deprived guys were trying to squeeze the tiniest amount of Tommy Bahama chill into their hectic lives by covering up a few buttons down their midline.

I never pursued Wall Street life after that field trip, but it was damn clear that these bankers were paid. Those boys had money and you could feel that something was different down there on Wall St.

Us “normies” see money as something you earn, save, and spend. It’s straightforward and linear like time and grammar school math.

What you don’t understand is that these pastel tie wearing ADHD bankers and economists see the world differently than you and I. Money isn’t just something you earn, save, and spend. It’s something you shape, create, lend, borrow, collateralise, print, trade, tuck into panties, and snort coke with. It’s the Swiss Army knife of all goods.

Which begs the question: when was the last time you questioned your ideas about money? What is a dollar?

The truth is that the dollar today isn’t what it was when your parents were born and it very likely won’t be what it is now when your grandchildren are born. One secret of the banker-economist trade, reserved for the upper-echelon ADHD Adams, is that the dollar doesn’t have to be a dollar. It changed overnight in 1971, and it’s changing again right now.

This is the unfinished story of money and the greatest, most dangerous and volatile experiment in monetary history.

Buckle-up! We’re going back in time to understand the history of the US dollar, and how the world economy is basically at the whims of attention-deprived 5th graders.

The greatest monetary experiment in history isn’t Bitcoin, cryptocurrencies, DeFi, or NFTs.

It’s the US dollar.

How the hell did we get here? And, what’s next?

Incorporated Prosperity

What happened to the US Dollar in 1971 was a momentous moment marking the failure of decades of technical management of complicated systems that economists were accustomed to convoluting for the public’s self-interest. But it’s much simpler to grasp what happened by revisiting our friend ADHD Adam and how he became the tyrant of the Oregon Trail game.

As we crossed the imaginary American West, our band of 5th grade settlers were focused on survival.

But as we got to our destination the game changed. We incorporated a town. That was the actual word our teacher used. Incorporated. I’m doubting she knew what it meant because what came next was an utter joke.

We all got assigned the roles you’d expect to see in a new town. She picked the roles out of a hat like we were in Harry Potter. We had shopkeepers, deputies, and a few other sorts. Yours truly was the Tavern Owner.

I was one of the few business owners in town and I knew, without a doubt, I was going to make a lot of moola. A lot more than those sorry lot of farmers.

In one of those rare childhood gifts, ADHD Adam was named banker.

I instantly sniffed out the danger here before it became obvious to everyone in the greater Upper Valley Connecticut River catchment area: you don’t put anyone who is HYPER in charge of the money supply.

To be fair, our little experiment in hyperactive banking started off totally fine. ADHD Adam had no idea how to be a banker, and to his credit, no 5th grader understands credit and loans and how money works. So Adam stayed close to the teacher, gaining valuable tips on how to lend money to the townspeople so everyone prospered. And prospered we fucking did.

We had incorporated a first rate utopian 5th grade settlement in the middle of the American West. Complete without harming a single animal or indigenous tribe member. We couldn’t believe our luck.

But, as we all know, luck comes and goes.

America’s Prosperity

The US dollar went through a similar period of illusion. For the first 30 years we went off the gold standard, and everything seemed to be going fine. But, everyone knew from history, the dangers of uncontrolled printing.

The first half of the 20th century is illustrative of the perils of rampant money printing. In the United States, you had the roaring 20’s that ended in the stock market crash and led to the Great Depression. In current day Germany, the Weimar Republic pretty much skipped the enjoyable 20s and went right to the Great Depression. In both cases, excessive money printing and economic mismanagement led to catastrophe.

Before you know it, we have one of the most evil humans of all time parading around Europe collecting countries like 5th graders collect pogs. (More on pogs later.) World War II ensues, and after all is said and done in 1946, the world leading economists meet in a small town in New Hampshire, only a bit more than an hour’s drive from my hometown.

The Bretton Woods experiment was a disaster you could predict from the start. You get a bunch of spend-happy economists sitting in a beautiful rural setting in God’s Country, USA and they come up with a system to do one thing and one thing only: create balance, safety, and economic security for all.

Well, except the Soviets. Those dudes were scary and no one wanted to invite them to this capitalist experiment. Not that they would have accepted the party invitation.

These banker-economist types had learned their lessons from the economic period after World War I and designed a system where government money printing couldn’t possibly lead to stock market crashes, dystopian regimes, or inflation so bad you need wheelbarrows of money to buy a loaf of fucking bread.

“Wheelbarrows of cash” is called hyperinflation. Recognize the “hyper” part? It’s the “H” in ADHD Adam.

So in my best 5th grade presentation voice, I tell you that Bretton Woods tried to bury the money printer by doing two things. Number one, they pegged the US dollar to gold and all other currencies to the dollar. This meant that every currency was tied back to gold through the US dollar. And number two, just for safe measure, America would keep all the world’s gold in the Fort Knox vaults.

What could possibly go wrong?!

The system worked theoretically, but everyone hated it. A “fixed exchange rate system” leads to all sorts of economic gymnastics -- economists had to contort things in impossible ways just to meet the rules of the game. It made international trade almost impossible. It made economic prosperity almost impossible.

On top of all that, poor old America was sweating like a Red Bull fueled 5th grader at afternoon recess. The United States bankers had to keep enough US dollars in supply to keep the world economy running smoothly so they resorted to printing money. But every time they did that, they had to put more gold in their vaults to keep the proper ratio of 35 US Dollars to one ounce of gold.

At some point, the Americans gave up on finding the gold. It was too tough, so they cheated. At first, just a little bit, but eventually, a lot. They printed even if they didn’t have the gold to back it up.

When the rest of the world caught on in the late 1960s, they asked for their gold back. It was like a worldwide bank run on Fort Knox. Uncle Sam had been printing money for decades and each ounce of gold was surely worth more than 35 US Dollars.

And so in August 1971, President Nixon said, “Oh, fuck this game.” He dumped the gold standard for the fiat standard. Fiat means “by decree,” so all your dollars were not backed by gold now, but by government decree.

And the world’s most-favored-status economists and bankers sighed a collective sigh of relief.

In the three decades after 1971, anyone who was well aligned with the Americans saw unprecedented economic prosperity. Almost every measure of country level economic well-being went up from 1971 to the turn of the century. We all know this as the rise of the baby boomers and the American Dream.

Just like when Adam heeded the teacher’s banking advice in our incorporated town, relatively good oversight of this new fiat system led to economic prosperity. But when money is by decree, the temptation to print more is, eventually, just too tempting.

ADHD Adam and our most-favored-status money men had grand designs for their futures. These grand designs combined with unchecked power are not a good combination.

Hindsight might be 20/20, but some things are doomed from the start: Bretton Woods, gold standards, and ADHD Adam the banker.

Incorporated Decline

I remember the smirk on Adam’s face when he realized he was the only bank in town.

ADHD Adam’s epiphany was simple: “If I’m the only banker in town, and no one in town can earn more money without getting a loan to expand their farm, shop, or tavern, well then I can use this to my advantage.”

He was gonna be rich as shit as he squeezed his monopolistic vice on the townspeople. If you wanted to do a deal with the bank, ADHD Adam was gonna get 99% of the upside and you were gonna get the scraps.

And as soon as he got the lay of the land, he stomped on the teacher’s recommendations. ADHD Adam had the town by the balls.

The story of our kid tyrant parellels the history of the US dollar and the money men that control the world’s economic system. There have been moments of fairness and prosperity, but as time marched on their realized power got the best of them, and they went completely nuts.

I don’t know if all the other fifth graders understood what was going on, but there is no way I was the only one. This was highway robbery and the perpetrator was a smirking, cackling fifth grader.

But like all good things, it had to come to an end.

One by one, us fifth graders wisened up. There was just no getting around the fact that ADHD Adam was having way more fun than the rest of us. He was making bank at our expense and he was having a grand ol’ time doing it.

I don’t blame him. I’d probably have done the same if I had been the luckily ordained banker.

American Decline?

After decades of relative prosperity, America survives Y2K (with ease) and the Dot Com Bubble (with less ease), but life is good in America. By the mid 2000s, we’re looking at a roaring decade of prosperity. Everyone is a property owner and the American Dream has never been more vivid.

For a kid like me growing up in a rural blue collar town with a home builder for a father and a realtor for a mother, I guess you could say we experienced the best of it.

Then the wheel falls off our wheelbarrow. 2008 sees the world economy drop into the worst downturn in three generations. Lehman Brothers, a major Wall Street bank fails, Bear Stearns has to get bought to avoid going six feet under and everyone is left scratching their heads, “What the hell just happened?”

This became a major problem for everyone. Us layman types could be forgiven for not understanding nor predicting the overnight meltdown.

Everyone is scared shitless, especially the bankers and economists in charge of our national wellbeing, so the government pulls out the ultimate economic weapon: the money printer.

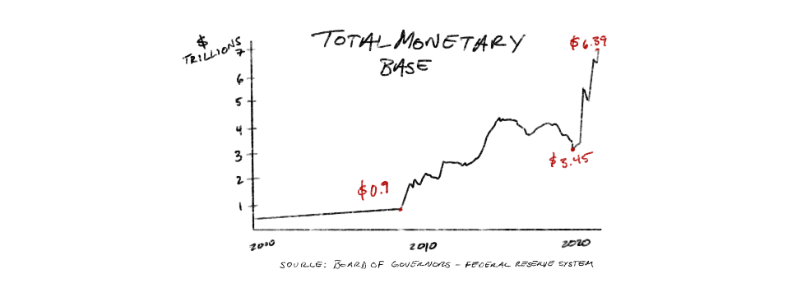

One way to spot a very very bad idea is to count how many syllables it takes to describe it when there is a shorter alternative. When you describe “print money” as “quantitative easing,” you’re fucked. 2 syllables versus 6 syllables. That’s 3x the syllables and that’s about what the government prints over the coming years. 3x more money to bail ourselves out.

Now you may not have known this, but there has been a longstanding set of shady characters in the economics community, and 2008 was their big break. Before the crash, governments thought of themselves like a household with income, expenses, and a responsibility to keep a balanced budget. In other words, you can’t spend lunch money you don’t have. But the crash changed all that. These shady characters start whispering in the ears of the beaurocrats and they have a compelling path out of this mess.

They basically had one rule: THERE ARE NO FINANCIAL RESTRAINTS. If you needed to buy lunch, but had no money, you could just create some bills out of thin air. Does this remind you of anyone from fifth grade?

Fast forward from 2008 to 2019, and despite the Great Recession ending in 2012, the Quantitative Easing (money printing) never ceased. It just ramped up more and more.

Then you get to the pandemic, which ramps things up to unimaginable levels. In 18 months we doubled the money supply. Let me repeat this, in 18 months we print as much money as we ever printed in the history of the United States. At the current rate of (hyper)inflation, your money will be worth half of what it is now in just a few years. Better spend it while it’s good. You’re essentially getting poorer everyday. Like the Oregon Trail game after ADHD Adam went rogue, it’s getting less fun to play every day.

Remember what we learned in 5th grade, do not put someone hyper in charge of the bank. Bad things happen.

Pogs

But when one game ends, another pops up.

And in fifth grade, that new game was pogs. Yes, the little cardboard chips and big slammers. Now that was fun. Fuck ADHD Adam. Fuck make believe Oregon Trail. Fuck make believe incorporated Town. We found a new game, and in its own way, it wasn’t that much different than the game of money.

Pretty quickly everyone had some pogs and at least a slammer or two. People practiced up, wagered against their competitor, and pogs exchanged hands. It was an open and free market. Participants could freely choose who to play or not to play, what to wager or not to wager, and their success was driven by their skill or lack of skill.

Pretty much the exact opposite of our economy in make believe Town.

Yet within weeks, we had the regulators down our throats. Parents and teachers collectively united and proclaimed that our little pogs game instigated gambling, bullying, and racketeering.

The juxtaposition of ADHD Adam’s unfair monopoly in our made up town and the fairness of the pogs world was poetic. One was fully sanctioned by our teacher, the other not. The morals of this odd juxtaposition is tough to figure out as a fifth grader. Which is why we settle for the “rules” and enjoy the forty minutes of freedom we have at recess.

Just like the pogs phenomenon emerged out of ADHD Adam’s bullshit, new money games were created to account for the delirium of the dollar.

Plan

Not long after the crash of 2008, someone or some group of people are watching the financial meltdown and realize that bankers aren’t the solution, but the problem. The thesis is straightforward: a small group of elite people who have the unchecked power to print more money will eventually print more money. Every ruler, king, or government, past or future, with the power to print more money, will do so until things collapse.

I’d argue it’s not their fault. I know I’ve been poking fun at ADHD Adam and economic sages for quite a while now, but I truly think the money printer corrupts these benevolent leaders through an incredible bribe. The soft purr of the money printer is hypnotizing, “I can make all this easier right now, if you just hit print.” The thing about bribes is they are a very special sort of deal. They are overwhelmingly good for you in the short term, but overtime, they can lead to peril. When I think about Adam, we should have heeded Shakespeare’s advice, “Neither a borrower nor lender be.” It was a slippery slope dealing with Adam and it ruined the game over time. It’s not one bribe, but a long series of bribes that doom us.

And so Satoshi Nakamoto, an anonymous entity, sets out to break the spell of the money printer. His idea is a digital money, called Bitcoin, that can never ever have its supply increased. As it sits now, it’s a fledgling asset that piques interest amongst many, but it’s a Plan B for a small set of hardcore supporters who understand the danger of our world economy being run by a gang of hyper kids.

If Bitcoin’s fate look anything like pogs, I’m pretty sure the path forward is fraught with burdensome oversight, similar to when those sappy parents and do-good teachers took our pogs away.

Beyond that, it’s anyone’s guess for Bitcoin, but so too is the future of our current system built upon the US Dollar. Our failure to see both as avant garde experiments is dangerous. Your failure to pay attention adds to the volatility. I beg you: stand watch, stay vigilant.

Because when no one is watching, bad things happen.

The next momentous monetary experiment is Bitcoin. Like the Oregon Trail, it’s the next frontier. But as we sit here today, the biggest, most dangerous monetary experiment is fiat money and the US dollar. This is unquestionable. The only question that remains is how do you react? We can’t just graduate on to sixth grade. Either we convince our teachers to play pogs with us, or we’re trapped in the hell of ADHD Adam forever.